In America a dollar today is worth much less than a dollar in 1980. Americans marvel at how much cheaper things used to be in the past, when Coca-Cola and movies only cost five cents.

In Japan the story is quite different. For long periods in the past two decades, nominal prices have in fact declined.

These facts reflect a conscious decision made by the authorities of both countries. The United States, like most of the world, has accepted and even encouraged a slight degree of inflation. The belief is that this will encourage spending, providing a continuous boost to the economy.

Japan – for better or worse, probably for worse – has done things differently. It has not encouraged inflation; prices have stayed the same or even decreased in nominal terms. This reflects the strong power of the often elderly Japanese saver, who doesn’t want her savings to lose value. Today Japan’s new government is undertaking a bold course by forcing the Central Bank to print as much money as possible until inflation hits 2%.

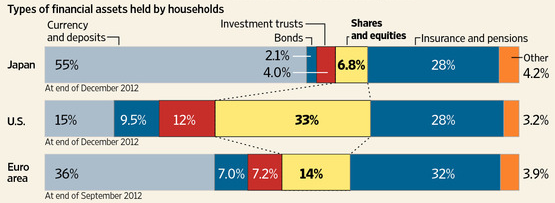

These different policies have created different attitudes towards saving in both countries. In the United States saving is often associated with the stock market. Americans ought to invest their money in the stock market for retirement because “the stock market will always go up.” Japan’s stock market has done poorly over the past few decades, however. As of this writing, the Nikkei 225 is at 14,937.56 – far below its high of 38,957.44 in 1989. A Japanese saver who invested all his earnings in stocks during the 1980s would have lost a lot of money. Instead, Japanese households keep their earnings in cash. This graphic, from the Wall Street Journal, shows this:

Cash is a much safer way of saving in Japan than in the United States; it doesn’t lose as much value over time, unlike here.

There is much to be said about the Japanese way of saving. The American method is complicated. Investing in stocks requires lots of tough decisions: how much money to put in, how conservatively to invest it, which mutual fund or plan is best, how to diversify, etc. There are lots of big words which the typical person might not understand. The whole process often takes a considerable amount of time and effort. The poor often lack this.

In a sense, then, the American system of saving exacerbates income inequality. Wealthy Americans save in stocks and bonds and are shielded from inflation. Poor American save in cash and bear the brunt of the blow. Is it a coincidence that Japan is much more equal than America?

For all its disadvantages, however, the American system is probably better than the Japanese system. It is Japan which is trying to create inflation and make itself more like America, not the other way around. What is more, Shinzo Abe’s government is wildly popular for doing so.

Still, few policymakers consider how a system of saving based on the stock market, due to inflationary pressures encouraged by the government, widens income inequality. Perhaps the overall economic advantages still outweigh the disadvantages. But more people ought to pay attention to the disadvantages.

–inoljt, http://mypolitikal.com/